I always thought family was the one place you could count on unconditional support.

I’m Alex, 36 now. This happened from 2022 to late 2025 — the slow-motion financial disaster that started with one “yes” to my Uncle Ray.

Ray was my mom’s younger brother — the charming one. The storyteller at every holiday, the guy who’d slip you $20 as a kid and say “Don’t tell your mom.” He’d had a rough go: divorced twice, a string of failed businesses, but he always bounced back with a new idea and a grin.

In spring 2022, he came to me with the “big one.”

He’d found a partner to open a craft brewery taproom in our mid-sized Texas city. Prime location, great concept — local ingredients, live music, family-friendly vibe. He had half the startup money from investors, but the bank needed a cosigner for the $350k business loan because his credit was shot from past ventures.

He asked me.

“Alex, you’ve got that solid job at the engineering firm, perfect credit, own your condo outright. Just your name on the loan — I’ll make every payment. You’ll never have to put in a dime. This is my legacy. Help your old uncle out?”

I was 32, single, no kids, six-figure salary, $80k in savings, 820 credit score. I’d just paid off my condo early. I felt secure.

Family first, right?

I said yes.

Signed the papers in June 2022. Told myself it was temporary — he’d refinance in a year once the business proved itself.

The taproom opened in fall 2022 — packed crowds, great reviews, social media buzzing. Ray sent photos: him behind the bar, toasting with the mayor. Payments were on time the first six months. I relaxed.

Then 2023 hit.

Supply costs skyrocketed. Construction delays on a second location drained cash. Ray started “restructuring” — missing one payment, then two. Bank called me: “Just a blip. He’ll catch up.”

He didn’t.

By summer 2023, he was $42k behind. Bank demanded payment from me — the cosigner.

I panicked.

Took $50k from savings to bring it current. Ray swore it was a bridge — business was turning around.

It wasn’t.

COVID hangover, inflation, competition — craft beer scene got saturated. Revenue flatlined.

Ray stopped answering my calls.

In January 2024, the business filed Chapter 11. Bank seized assets. Loan still had $280k outstanding.

They came after me.

I hired a lawyer — too late. Cosigner liability is ironclad. I was fully responsible.

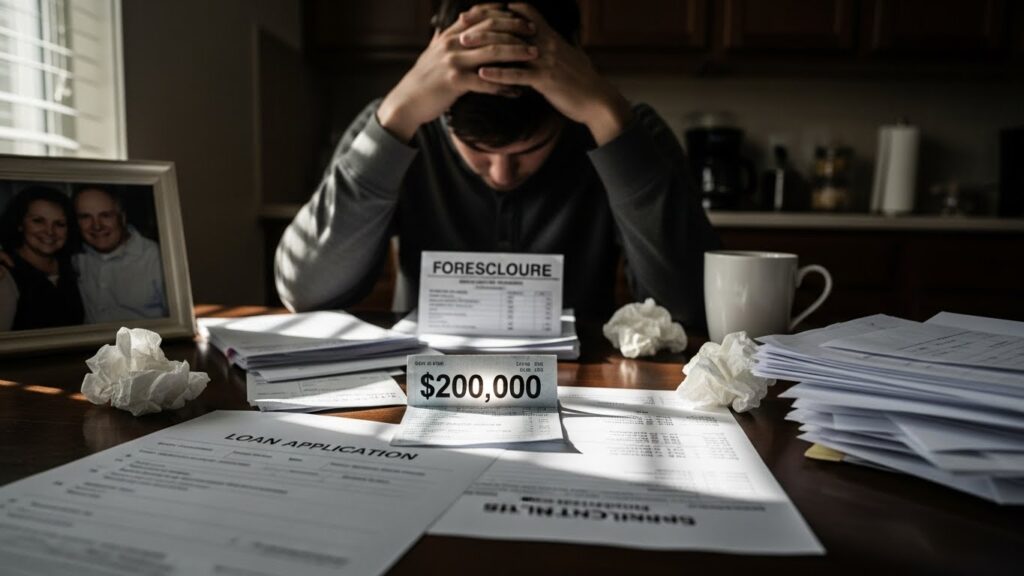

I liquidated everything.

Sold my condo — took a loss in a cooling market. Drained retirement accounts (penalties + taxes). Cashed out investments. Borrowed from my 401k.

Still short.

Credit cards maxed for legal fees and living expenses.

By fall 2024, I was $180k in debt, renting a tiny apartment, credit score in the 500s.

Couldn’t get approved for a car loan. Job offers rescinded when background checks showed financial distress.

Ray?

Declared personal bankruptcy in 2025. Walked away clean — no assets left to seize.

He sent one text: “I’m so sorry, kid. I never meant for this to happen.”

Then blocked me.

My mom — his sister — begged me not to sue him. “He’s family. He’s suffering too.”

I didn’t sue.

But I cut contact.

Stopped going to family events where he’d be.

Told my cousins the truth when they asked why I “abandoned” Uncle Ray.

Some believed me. Some defended him — “Business is risky. You knew that.”

Thanksgiving 2025? I spent alone.

It’s December 31, 2025 now.

I’m rebuilding — slowly.

New job (lower pay, but stable). Debt consolidation plan. Living on rice and beans. Therapy for the anger and shame.

Credit inching up. Savings: $3,200.

I’ll be paying this off until I’m 50.

Ray opened a food truck last month — crowdfunded by family friends who don’t know the full story.

He posted photos: smiling, new venture, “Third time’s the charm!”

I didn’t react.

The favor cost me my financial security, my home, my peace.

But the deepest cut?

Realizing family isn’t always unconditional.

Sometimes it’s conditional on you never asking them to face consequences.

I said yes to help a man who called me “kid” and told stories at Christmas.

He said thank you by letting me drown so he could swim.

Never again.

Blood may be thicker than water.

But it doesn’t make bad decisions any less heavy.

I learned the hardest way: the biggest financial risk isn’t a bad investment.

It’s trusting family with your future.

Because when they fail, they can take everything — and still sleep at night.

While you’re left picking up pieces they never intended to help carry.

TL;DR: Cosigned a $350k business loan for my uncle’s brewery out of family loyalty. The business failed, he defaulted and went bankrupt, leaving me — the cosigner — solely responsible for the debt. I lost my home, savings, and perfect credit, sinking into six-figure debt I’ll carry for decades. The “small favor” destroyed my financial life.